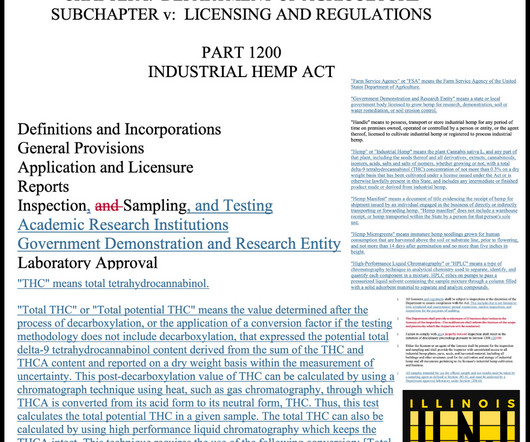

Illinois Industrial Hemp Act amendments receive second notice

Illinois News Joint

OCTOBER 25, 2024

The provision now states, “All licensees and registrants shall be subject to inspections at the discretion of the Department to ensure compliance with the Act. For example, academic research institutions “shall notify the Department at least seven business days prior to collection of samples.”

Let's personalize your content