April 20 2022: Attaining Compliance in the Cannabis Universe

Cannabis Law Report

APRIL 9, 2022

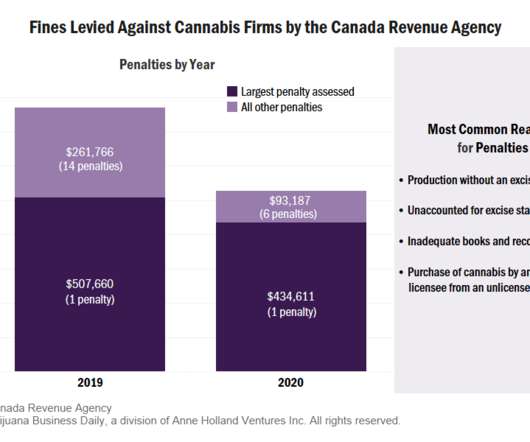

Compliance in the cannabis industry is fraught with risk across areas like licensing, equipment, testing, distribution, and retail sales – and insurance professionals are a big part of addressing all of that (or they should be). Big trends and developments in compliance. Compliance standards, and the toughest states.

Let's personalize your content