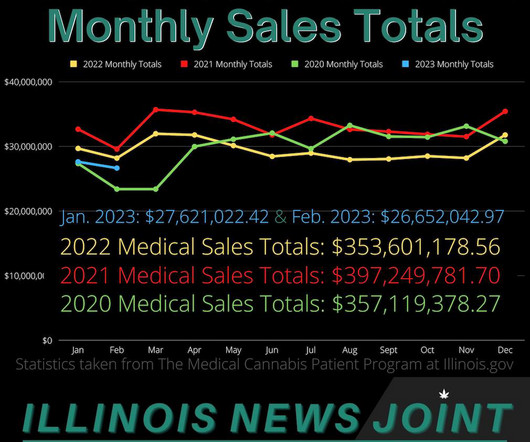

Illinois 2023 medical sales lowest start in two years

Illinois News Joint

MARCH 4, 2023

In January 2023, Illinois collected $27,621,022.42 and in February 2023 Illinois collected $26,652,042.97. Total retail sales since November 2015 by licensed medical cannabis dispensaries is $1,693,048,677.29. Total 2023 wholesale sales by cultivation centers reached $79,407,155.34. and $28,187,064.97, respectively.

Let's personalize your content