Alert: Newsom To Present Cannabis Tax Simplification Solutions To Legislature

Cannabis Law Report

MAY 13, 2022

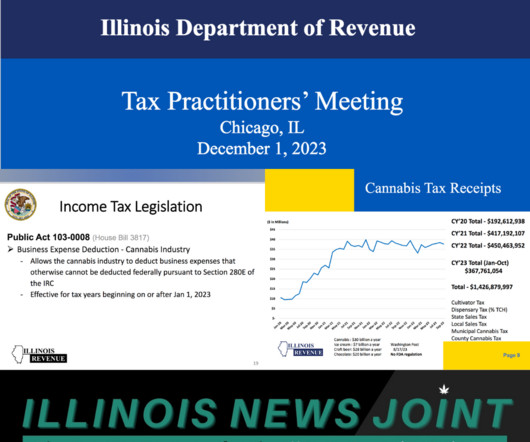

Shifting the point of collection and remittance for excise tax from distribution to retail on January 1, 2023, maintaining a 15 percent excise tax rate. Strengthening tax enforcement policies to increase tax compliance and collection and reduce unfair competition. million to help expand access to legal retail throughout California.

Let's personalize your content