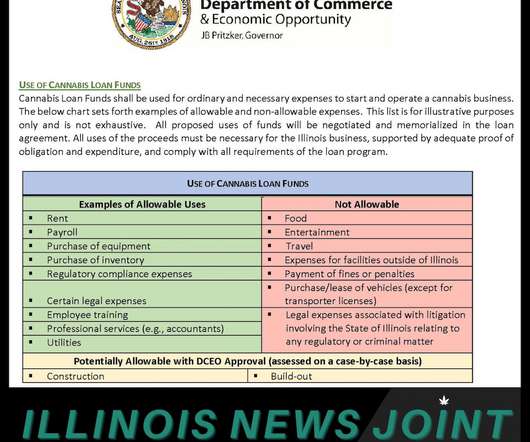

Senate Coalition Urges SBA to Support Small Cannabis Businesses

NORML

APRIL 2, 2020

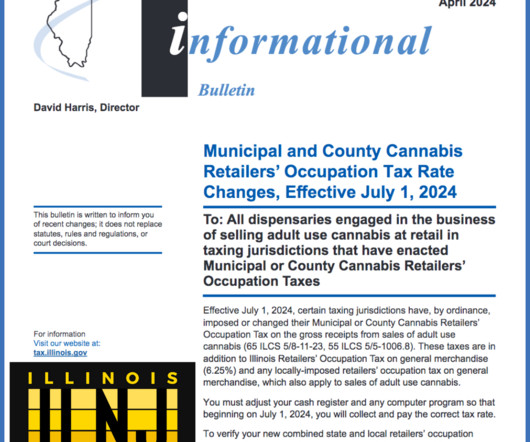

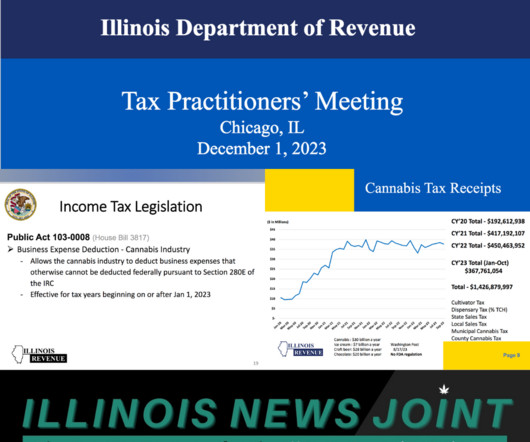

The Senators write: Over the last decade, there has been a clear shift in public opinion toward supporting the legalization of cannabis in the United States. States collected an estimated $1.3 billion in tax revenue from legal cannabis sales in 2018.

Let's personalize your content