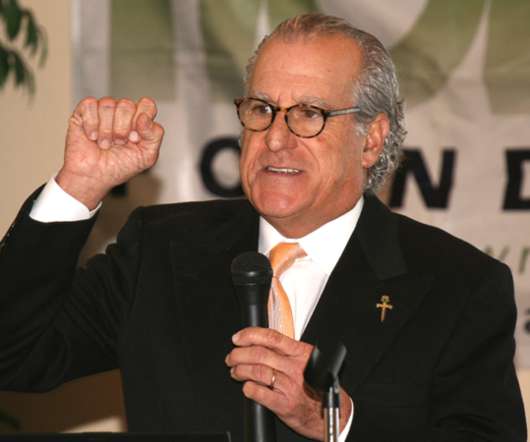

A Founder Looks at 50: Attorney Gerry Goldstein and the Early Years of NORML

NORML

JUNE 5, 2020

When Goldstein contacted Beto to indicate we had a couple of national journalists willing to come interview marijuana prisoners, the warden agreed to assemble a collection of a dozen or so non-violent marijuana offenders and to provide us the space to interview them within the prison.

Let's personalize your content