Aspergillus brasiliensis is NOT Aspergillus niger

Medicinal Genomics

DECEMBER 9, 2021

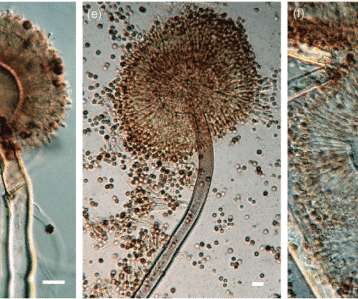

In 2007, researchers reviewed black aspergilli samples from around the world and realized they were not all the same. paper, The American Type Culture Collection (ATCC) renamed two strains in their collection (ATCC® 16404TM and ATCC® 9642TM) from Aspergillus niger to Aspergillus brasiliensis. niger assays that do not exclude A.

Let's personalize your content