NY: Indigenous Tribes Taking Lead On State’s Cannabis Legalization Says Article

Cannabis Law Report

AUGUST 3, 2021

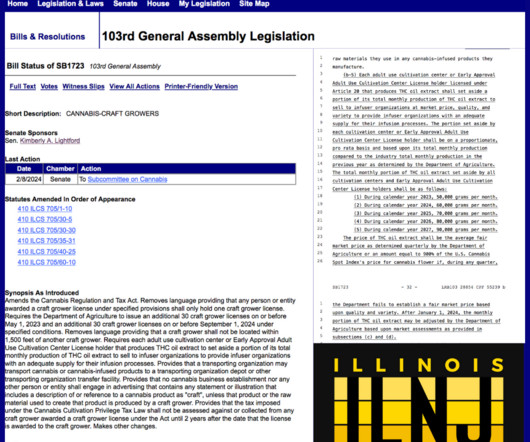

Andrew Cuomo for dragging his feet on setting up marijuana sales and cultivation regulations. But the most simple way to understand it is that sovereign tribes are free to legalize – or ban – marijuana within their territories, including its cultivation and sale, independent of the state. Read the full article at [link].

Let's personalize your content