Cannabis Is Helping Cultivate Jobs in More Than Dispensaries

Veriheal

FEBRUARY 23, 2023

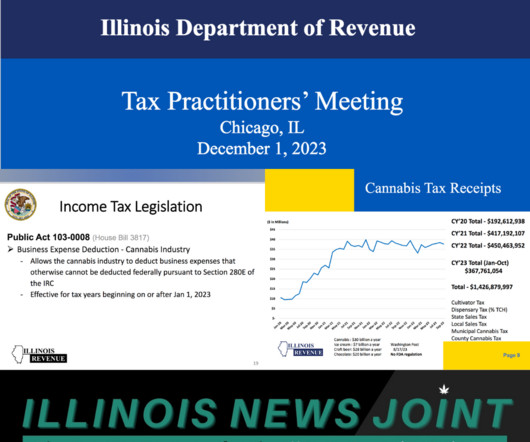

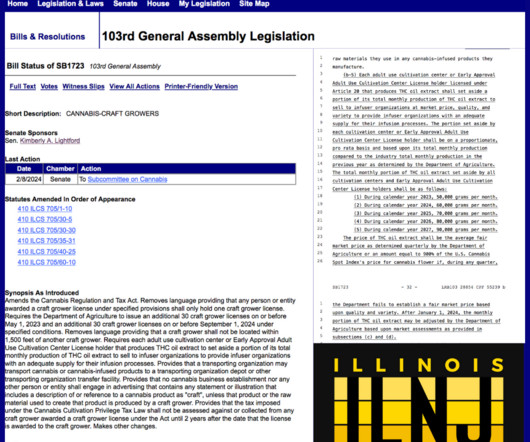

Flowhub says, “Nearly $3 billion in retail cannabis taxes were collected in 2022.” There is a great amount of detail that goes into cultivating a successful crop of cannabis consistently. The post Cannabis Is Helping Cultivate Jobs in More Than Dispensaries appeared first on Cannabis Central.

Let's personalize your content