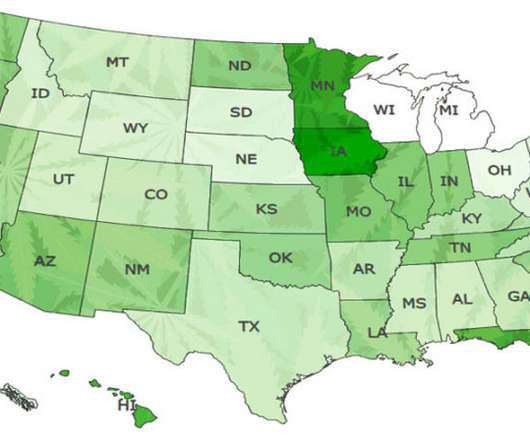

U.S. Cannabis Legalization Update: Who’s Still Waiting and Who May Legalize

Veriheal

NOVEMBER 6, 2023

Despite this massive shift in cannabis policy, however, a few states are still dragging their feet on cannabis legalization. It prohibits cannabis possession, use, purchase, sale, or cultivation, whether for recreation or medical purposes. The Act aimed to provide patients access to smokable flower for 15 medical conditions.

Let's personalize your content