Over 40 Members of Congress Request SBA Access For Small Marijuana Businesses

NORML

APRIL 22, 2020

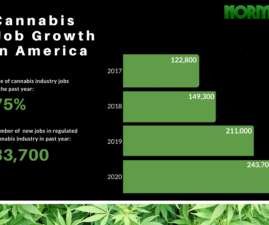

“Many of these establishments are small-to-medium size operators, with their employees keeping their doors open without access to the support systems in place for other businesses, thus depriving them of potentially lifesaving protections.” The majority of these businesses are small-to-medium in size.

Let's personalize your content