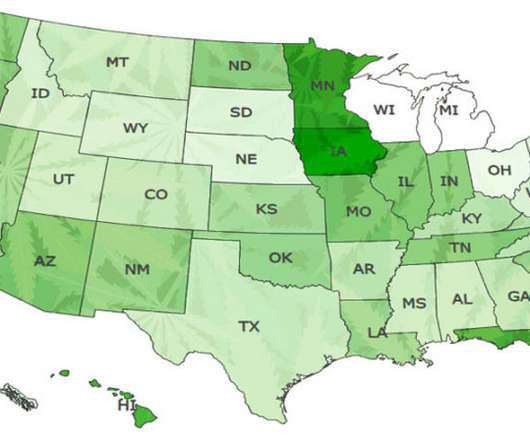

California Governor Proposes a Cannabis Tax Reduction in an Effort to Shore Up the Legal Market

Cannabis Law Report

MAY 16, 2022

Gavin Newsom introduced proposed revisions to his 2022-2023 budget proposal, which would eliminate the cannabis cultivation tax rate beginning July 1, 2022. Currently, the cultivation tax rates are $10.08 per ounce of fresh cannabis plant, and these taxes are paid on all recreational and medicinal cultivation of cannabis.

Let's personalize your content