Summary

- Israel is expected to pass legislation in September, legalizing CBD and decriminalizing cannabis.

- cbdMD has granted IM Cannabis the exclusive right to import and sell their CBD products in Israel.

- cbdMD reported Q3-2021 CBD revenues of $10.6M and operates at a net income.

- IM Cannabis reported Q1-2021 cannabis revenues of CA$7M and operates at a net income.

- I rate both companies as a neutral buy and recommend that investors watch their financial performance.

cbdMD (YCBD) manufactures and sells broad spectrum CBD products for humans and pets. IM Cannabis (IMCC) is a multi-national cannabis operator with operations in Canada, Israel, and Germany. IM Cannabis will be ready to sell cbdMD’s products as soon as the Israeli government passes the legislation. The partnership allows both companies to gain from Israel’s estimated $475M CBD market.

Both companies have recent business developments worth noting and this partnership will create some synergy for them. Neither of the companies currently presents strong buy signals. cbdMD recently posted their Q3 quarterly reports Thursday after-hours and showed a consistent revenue stream from quarter to quarter as well as a net income. IM Cannabis also works at a net income and reports consistent revenues. The company predicts Q3-2021 will contain a significant increase in revenues from their current business strategies.

My investment thesis is to watch the two companies closely. Ideally, the companies will have increased revenues from their operations and their financial statements will improve. The larger market is not bullish on cannabis nor CBD for the time being. I rate the companies as a neutral buy and believe that a buy-signal may present itself over the next year, as finances improve as well as stock price movements.

Partnership and Israeli CBD market

By the end of September, the Israeli government is expected to pass a bill which decriminalizes cannabis and allows CBD to be a legal food supplement. The partnership allows IM Cannabis to import and sell cbdMD’s products in Israel upon the passage of the bill. cbdMD manufacturers a large variety of CBD products for humans and pets, including tinctures, topicals, gummies, pet chews, body creams, and bath salts.

IM Cannabis Business Strategy and Financials

IM Cannabis operates in Israel through a licensing agreement with Focus Medical Herbs, which grows the company’s proprietary strains and IMC brands. IM Cannabis has made recent acquisitions in the Israeli medical cannabis market. In July, IM Cannabis announced its acceleration of the acquisition of Pharm Yarok, Rosen High Way, and HW Shinua. Pharm Yarok is a medical cannabis pharmacy in central Israel, which sells about 2,200 pounds of cannabis per year. Rosen High Way is a trade and distribution center for medical cannabis, including storage and distribution. HW Shinua is a company which plans to transport medical cannabis to and from Pharm Yarok and Rosen High Way. They will also be able transport medical cannabis from other third parties, including growing facilities, pharmacies, manufacturers, and distribution centers.

IM Cannabis acquired the three companies for CA$4.6M. According to their press release the combined annual revenue for the three companies is CA$8 million. IM Cannabis, in return, has acquired a license to sell medical cannabis, including online, a customer service center, a virtual store, a warehouse center, and a customer base. The acquisition complements their previous expansion in Israel via their purchasing of certain assets from Panaxia [TASE:PNAX], the largest manufacturer of medical cannabis in Israel. IM Cannabis acquired Panaxia’s at-home distribution platform and in-house pharmacy. IM Cannabis will be well positioned to distribute cbdMD’s products in the new legal market.

IM Cannabis also has robust operations in Canada and Germany. In Germany, the company operates under its fully owned subsidiary Adjupharm GmbH. The company recently announced the completion of an 80k square foot packaging and distribution facility in Germany and the signing of a two new supply agreements from medical cannabis producers. Adjupharm has sales agreements with over 6,000 pharmacies in Germany.

In Canada, the company operates through JWC, which grows cannabis in Ontario and sells dried flower, pre-rolls, hash, and kief in the Canadian recreational markets under two brands, JWC and WAGNERS. Additionally, IM Cannabis recently acquired MYM Nutraceuticals and its subsidiary, Highland Grow, a licensed Canadian cannabis producer. Besides sales across all of Canada, IM Cannabis plans to export cannabis from Canada to Germany.

In May, IM Cannabis reported its Q1-2021 quarterly earnings. Their quarterly revenues were CA$8.7M, with a profit of CA$4.6M. The company sold 2,610 pounds of cannabis, although it is not clear from which markets the revenues derived. Net income to the company was CA$4.7M. They have CA $1.3M cash and no current debt. They forecast Q2-2021 revenues to be between CA $11M and $12M. Their German and Canadian operations will see increasing revenues and their new Israeli operations will be in full bloom. The company expects more robust revenue growth in Q3. The company has current assets worth CA$53.82M and total assets at CA$166.25M. Their current liabilities are CA $23.32M and long-term liabilities are CA $48.16M (asset and liabilities from www.TIKR.com).

cbdMD business strategy and Q3 financials

cbdMD sells a broad spectrum of CBD products for humans and pets. The company owns an extensive portfolio of CBD brands. They have three categories of products: cbdMD (100+ products), Paw CBD (40+ products), cbdMD Botanicals (15 products). They sell through their own e-commerce sites, third party e-commerce sites, select distributors, and brick and mortar retailers.

The company operates a facility in Charlotte, North Carolina totaling 135K sq. ft., where they manufacture tinctures, softgels, and capsules and stage distribution. The company receives its CBD from 3rd party providers and some of its branded products are made by 3rd party manufactures. Their facility and 3rd party manufacturers are GMP certified.

cbdMD has brand exposure through their sports sponsorships and athlete endorsements. They also have television commercials. Their business strategy is to grow their brands, add innovative products, and increase revenue streams. They recently acquired directcbdonline.com, which carries a variety of CBD brands. The company is planning CBD drink products and CBD powder for drinks. They want to expand their sleep products by making higher strength tinctures and softgels with additional levels of CBD. According to their most recent investor presentation, the CBD market in the US may reach $6.9B by 2025. The company is well positioned to take a greater share from this growing market.

cbdMD just released its Q3-2021 quarterly report. For the first time, the company is reporting a net income of $1.5M and a positive EPS of $.02. Revenue from quarter to quarter has been consistent. The company’s operating expenses have increased each quarter.

| In $US Millions | Q3 *

June 2021 |

Q2**

Mar 2021 |

Q1**

Dec 2020 |

Q4**

Sep 2020 |

|

| Revenues | 10.6 | 11.8 | 12.3 | 11.7 | |

| Cost Of Revenues | 3.3 | 3.6 | 3.4 | 5.3 | |

| Gross Profit | 7.3 | 8.2 | 8.9 | 6.4 | |

| Total Operating Expenses | 13.8 | 12 | 10.3 | 10.2 | |

| Net Income | 1.5 | (12.5) | (9.4) | (6.3) | |

| EPS | .02 | (.24) | (.18) | (.12) | |

| Current | |||||

| Price *** | 2.22 | 2.90 | 4.14 | 2.95 | 2.00 |

| Total Enterprise Value (MM) | 117.13 | 148.78 | 196.03 | 147.47 | 98.26 |

| Market Cap (MM) | 130.74 | 165.24 | 216.47 | 153.79 | 104.21 |

*Q3 is available here

**Data for other quarters available on Seeking Alpha

***Valuations from www.TIKR.com

The company’s Q3 revenues break down into $7.8M from e-commerce sales and $2.7M from wholesale and brick and mortar sales. They sold $1.5M in CBD products for pets. They have current working capital of $18.9M, current assets of about $30M, and total assets of $115.5M. The company’s current liabilities are $6.7M and long-term liabilities are $13.1M.

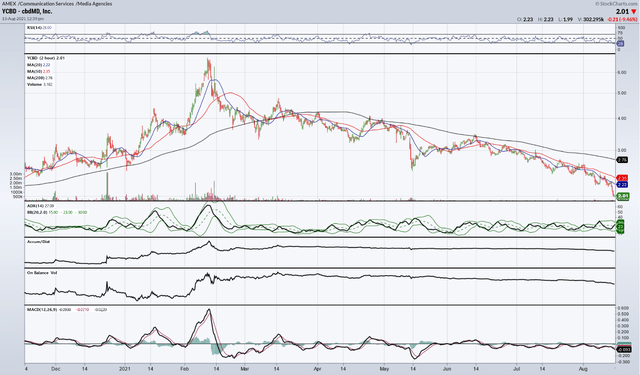

cbdMD’s stock price has been on a 5-month downtrend

YTD stock price performance chart from www.StockCharts.com

The stock price rallied back in February and March, reaching a high of $6.85, but has been on a serious downtrend since. It trades today around $2 per share. Its 1-year performance has been -41%, YTD -31.86%, and 3-mo -25.28%. It is currently trading below its 20/50/200 moving day averages. It has low volume with a 50-day average of 182K shares. The trend is leading the price to a new all-time low. 22% of the shares are held by large institutions.

The company also has a preferred stock (YCBD.PA) currently trading at $6.82 per share. Its high during the rally months was $10.50 per share. It has been on a downtrend since June. Its 1-year performance is -22.33% and YTD is -9.86%. Their preferred stock is outperforming their common stock.

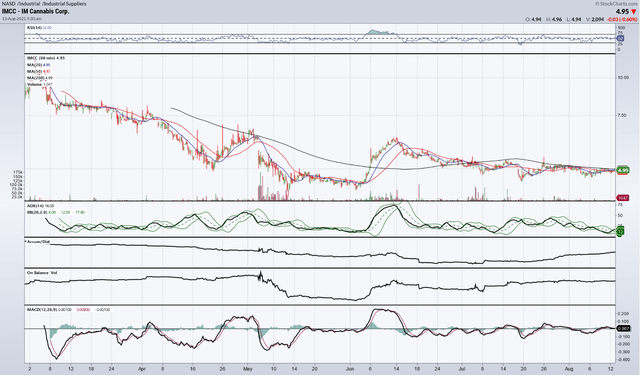

IM Cannabis has been on a downtrend since its listing last March

5-mo price performance chart from www.StockCharts.com

The company was just recently listed on the NASDAQ last March at about $11.60 per share. The stock price has fallen 39% over the last 6 months. It had some recovery in June, but still seems to be on the downtrend or at least a sideways zig-zag. Its 50-day average trading volume is 81K shares. Less than 10% is held by large institutions.

The company is also listed on the Canadian exchange (CSE). It hit its all-time high back in March at $14.40 per share. It has been on a downtrend since then. Its YTD is -41.54% and 6-month performance is -41.54%. It currently trades around CA$6 per share.

Investment Strategy: watch the two companies for buy signals

Both companies stand to gain from the emerging cannabis and CBD markets. Neither is overvalued. cbdMD trades at 2x its NTM Total Enterprise Value / Revenues and IM Cannabis trades at 3.8x its NTM Total Enterprise Value / Revenues (valuations from www.TIKR.com). A buy-signal will present itself when trading momentum increases for the stocks and uptrend begins. Financials too will need improvement. We want to see that IM Cannabis’ current business strategy of operating in three different countries produces higher revenues. cbdMD will need lower operating costs and higher revenues. Both companies operate on a net income and we want to see that income increase, as well as overall valuation.

Risks: Moderate to Low

Both companies have enough assets to outweigh their liabilities. There is no risk of liquidity or business failure. There is risk that these stocks will continue their downtrend before finding higher price channels. There is also risk that the larger stock market will remain bearish on cannabis companies and skeptical of their performance. We know that federal legalization will change the momentum, but until then the risk of loss is higher.

IM Cannabis is operating in two speculative markets: Israel and Germany. Their Canadian market comes with stiff competition. It is unclear what share of these market the company will gain or what regulatory troubles may come. The company is well positioned to take advantage of these markets and the potential for growth is strong.

cbdMD is well ahead of their competitors in brand acceleration and size of operations. Their current market segments present no regulatory issues and the CBD market is growing. The company is tasked with getting more revenue out of the CBD market. They are selling internationally, where CBD is allowed. There is less risk with cbdMD compared to IM Cannabis.

Conclusion

In conclusion, Israel is set to legalize CBD and decriminalize cannabis in September. IM Cannabis and cbdMD are well positioned to profit from the new market. They have made a partnership agreement so that CBD products will be ready for distribution upon approval of CBD. IM Cannabis has acquired the appropriate assets for the distribution of CBD and medical cannabis in Israel. cbdMD will benefit from increased revenue from importing their products to Israel and letting IM Cannabis distribute them. Both companies have the financial resources to fulfill this strategic partnership. At the same time, the larger stock market is bearish on cannabis and CBD companies. Both companies’ stock prices are experiencing downtrend and lack of momentum. Until these conditions improve as well as the companies’ financial performance, I rate both as a neutral buy and encourage investors to watch both of them.