Marijuana Moment reports

California collected about $817 million in adult-use marijuana tax revenue during the 2020-2021 fiscal year, state officials estimated on Monday. That’s 55 percent more cannabis earnings for state coffers than was generated in the prior fiscal year.

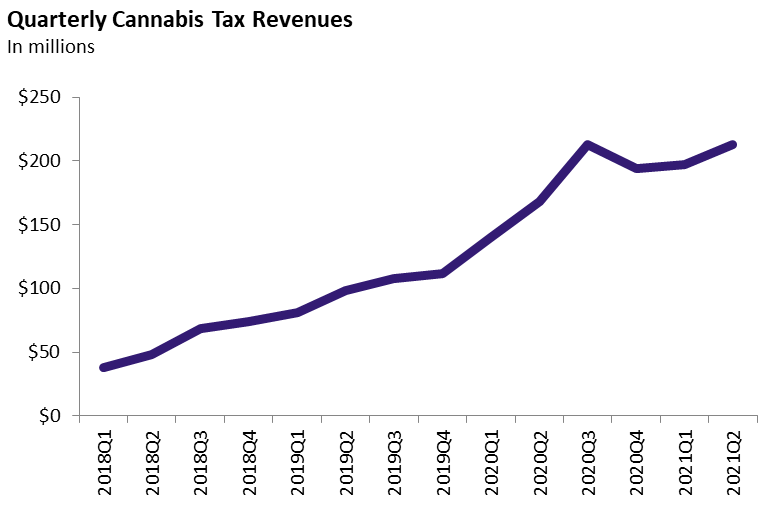

The nonpartisan Legislative Analyst’s Office said combined excise and cultivation tax revenue for the fourth quarter, which ended in June, amounted to $212 million—roughly tying the first quarter of the fiscal year for the most tax dollars raised in any single three-month period since legal sales launched.

The new figures do not take into account additional regular sales taxes generated from cannabis, nor do they include any local revenues to municipalities where the transactions take place.

Read full article at https://www.marijuanamoment.net/california-shattered-marijuana-tax-revenue-record-in-latest-fiscal-year-state-reports/

In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

Fourth Quarter of 2020-21: $213 Million. The administration currently estimates that retail excise tax revenue was $172 million and cultivation tax revenue was $40 million in the fourth quarter of fiscal year 2020-21 (April through June). (The overall total is slightly higher due to rounding.) This revenue total was roughly tied with the first quarter of 2020-21 (July through September) as the highest to date.

Prior Quarter Revised Upward. As of May, the administration’s cannabis tax revenue estimate for the third quarter of 2020-21 (January through March) was $163 million. As more taxpayers have filed returns for that quarter, the estimate has risen considerably, now totaling $197 million.

Preliminary 2020-21 Total: $817 Million. The administration’s combined estimates for all four quarters of 2020-21 are $652 million of retail excise tax revenue and $165 million of cultivation tax revenue. The $817 million total for 2020-21 is 55 percent higher than the total for 2019-20.

Other recent reports

Cannabis Tax Revenue Update [EconTax Blog]

Aug 23, 2021 – Cannabis Tax Revenue Update [EconTax Blog] Seth Kerstein In November 2016, California voters approved Proposition 64 , which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

https://lao.ca.gov/LAOEconTax/Article/Detail/687

Annual Report on Tax Exemptions for Medicinal Cannabis [Publication Details]

Jul 1, 2021 – Annual Report on Tax Exemptions for Medicinal Cannabis [Publication Details] Annual Report on Tax Exemptions for Medicinal Cannabis Format: HTML Description: Chapter 837 of 2019 (SB 34, Wiener) established new tax exemptions for donations of medicinal cannabis.

https://lao.ca.gov/Publications/Detail/4447

Annual Report on Tax Exemptions for Medicinal Cannabis

Jul 1, 2021 – Annual Report on Tax Exemptions for Medicinal Cannabis July 1, 2021 Annual Report on Tax Exemptions for Medicinal Cannabis Statutory Data Reporting Requirement. Chapter 837 o f 2019 (S B 34 , Wiener) established new tax exemptions for donations of medicinal cannabis.

https://lao.ca.gov/Publications/Report/4447

Cannabis Tax Revenue Update [EconTax Blog]

Jun 2, 2021 – Cannabis Tax Revenue Update [EconTax Blog] Seth Kerstein In November 2016, California voters approved Proposition 64 , which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

https://lao.ca.gov/LAOEconTax/Article/Detail/661