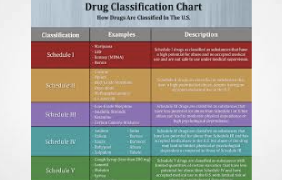

Senator Scott Wiener (D-San Francisco) introduced Senate Bill 1336, which establishes a carryforward tax credit for commercial cannabis retailers. Due to the high taxes levied on the legal sale of cannabis, commercial prices often cannot compete with the illicit market, leading recreational users and patients alike to purchase unregulated products and leaving small, legal businesses to suffer.

Under SB 1336, legal cannabis businesses will receive a significant tax credit equal to the amount of the following qualified business expenses: employment compensation, safety-related equipment and services, and employee workforce development and safety training. SB 1336 is sponsored by the United Food and Commercial Workers (UFCW) Western States Council.

SB 1336 recognizes the difficulties that commercial cannabis retailers face, and provides a hand to a unique and important part of California’s economy. In 2016, voters approved Proposition 64, to legalize the recreational adult use of cannabis and impose two types of taxes on commercial cannabis sales: a cultivation tax and an excise tax. Though these taxes generated $1.75 billion in revenue for the state between January 2018 and August 2021, they also have created a significant upcharge on legal cannabis, leaving room for grey and black markets with much lower prices. Without a tax credit for those selling legally, many commercial businesses providing safe and regulated products may not be able to meet their bottom line. This existential crisis for the legal industry will directly affect equitable access, especially for medicinal users who rely on safe and regulated cannabis products.

Read more

Senator Wiener Introduces Legislation to Create Tax Credit for Commercial Cannabis Retailers