With so much happening in the US marijuana industry, from IPOs to multi-million-dollar mergers, the year 2021 is poised to become a historical one according to business consultant Jasdeep Singh from CT.

Cannabis policy reforms are being pushed by advocates and lawmakers at the state and federal level. So much so that in states where marijuana is yet to be legalized, their leaders have been all but forced to hold press briefings and make formal addresses about their views of expanding access to medical and even personal marijuana usage. The growing audience of interested stakeholders can sense that the prohibition of weed is ending and there is money to be made.

Meanwhile, the first critical step to close the gap between national and state drug policy was taken in December last year when the Marijuana Opportunity Reinvestment and Expungement Act (MORE) was passed in the US House of Representatives. The purpose of the law was to deschedule cannabis from the Controlled Substances Act in essence legalizing marijuana at a federal level. It also seeks to abolish criminal charges for non-violent cannabis offenders while providing them with opportunities to turn their former illegal businesses into thriving small, and legal, ventures.

With only 33% of the US population living in states where marijuana is legally available, the market is primed to make a quantum leap if lawmakers succeed in pushing this bill forward.

Moreover, it is not just a coincidence that such sudden chain of actions to legalize marijuana is occurring at a time when the United States is struggling to emerge from the severe crisis caused by the coronavirus.

The truth is, Dr. Singh highlights, that it is important for current administrations at both the state and national levels to seek new sources of revenue from promising sectors within the economy.

Marijuana businesses will make a large contribution to US economic growth

To put this into context, Singh states that this industry generated nearly 250,000 full-time jobs last year, This represents a 15% year-on-year increase and is four times higher than the jobs produced by the coal industry in the United States.

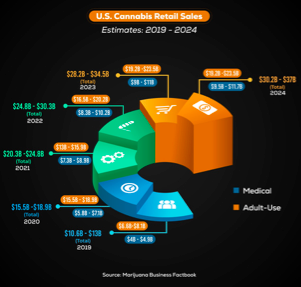

Additionally, the forecasted size of the global marijuana market is expected to reach USD $73.6 billion by 2027 with a CAGR of 18%. This provides a big opportunity for governments to gain tax revenues while also supporting the growth of small and mid-size businesses.

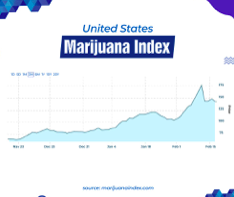

The financial markets seem to have noticed the attractiveness of this sector as cannabis stocks have been on a spectacular bull run. They are outperforming most broad-market equity indexes by posting a 200% gain in the past 12 months according to the US Marijuana Index.

The primary driver for this uptick has been the nod from both President Biden and his Democrat-led Senate, starting with Chuck Schumer, to support legislation that aligns with the House’s MORE Act.

In this context, all eyes are on the pot stocks, which include a wide range of businesses from producers, to extractors, to distributors, to supply chain facilitators.

From all the universe of weed stocks, Dr. Singh from Connecticut, US has mentioned two companies that could to have strong upside potential.

- Trulieve Cannabis Corp (TCNNF): The company produces cannabis for medical use and distributes it to its brand stores, mainly in Florida, and direct to patients. With possible legalization on the horizon, and past robust market experience, the company can easily branch out to new cities. Trulieve roughly doubled its sales during the third quarter of 2020 and already has plans to expand to other states.

- Planet 13 (PLNHF): A Nevada-based cannabis company that had one of the best market performances last year with its stock advancing as much as 190%. Even though their Las Vegas Superstore was operating at only 50% capacity due to the pandemic, third-quarter sales grew 36% compared to the previous year. The abolition of marijuana prohibition and the revival of the ‘City of Sin’ should collectively add more colors to their financial statement this year. The company recently raised $53.9 million in a public offering for further expansion, a clear signal of investor’s interest in this industry.

Bottom line

The marijuana industry looks stronger than ever this year. However, the question upfront in investor’s minds is when pot legalization might be realized.

The answer to this lies in the hands of both the President and lawmakers, and in possible competition with their other legislative goals.

The longer marijuana remains illegal, the longer the public, and governments, are losing out on solid revenues. The industry is certainly growing and attracting attention, so how long will lawmakers be able to ignore this incredible boon to our economy?