The language, as always, is dressed up as though they are doing a favor for cannabis investors and the like. We’d suggest they are getting jumpy about large sums of money not flowing their way!

Project Thunder implies they’ve been farting about on the issue. Maybe they should have called it Project Thunderpants because they are shitting themselves that capital will be flowing away from them!

Advisor Hub writes..

Revisiting the firm’s approach to clients with marijuana-related businesses ranked among a handful of initial items that Merrill Lynch Wealth Management executives have tackled in their Project Thunder initiative. The campaign, launched last week, is aimed at addressing frustrations and pain points endured by the brokerage’s financial advisors.

Merrill executives unveiled plans for “streamlining” and adding more “flexibility” to the process of onboarding clients who own or invest in marijuana-related businesses, as part of the new initiative, according to an internal message sent by the executives to advisors on Wednesday.

Advisors will now be able to seek approval for clients with marijuana-related businesses at the divisional level in “lower risk situations,” the message said, meaning they will no longer be required to secure a blessing from a New York-based executive in those instances. The policy change provides flexibility for clients who have a small part of their overall net worth connected to marijuana-related businesses, according to the company.

A Merrill spokesperson confirmed the internal message, which included two other Project Thunder “wins”: plans to have local recognition events in 2022 and, starting this month, more than “50 million views” of the Merrill brand at National Football League stadiums, digital platforms, and other locations.

The spokesperson did not provide more details about the announced changes by press time.

“Through this effort we’ve begun introducing what will be dozens of improvements in key areas, including making it easier to do business; product and platform enhancements; success and culture; and celebrating Merrill and all that it represents through increased visibility,” Merrill President Andy Sieg said in an emailed statement, when Project Thunder was unveiled last week.

Onboarding clients with marijuana-related businesses and investments has remained a sticking point at many brokerages because of the lack of uniformity among states and the federal government concerning recreational marijuana use and sales, according to Alma Angotti, a partner with the compliance consulting firm Guidehouse.

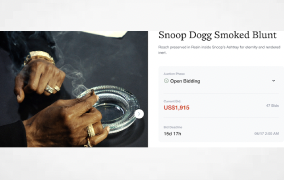

Although some states, including California, have legalized the recreational adult use of marijuana, a federal ban persists, so brokerages have set restrictions on prospective clients who have investments in the industry, safeguarding against handling assets based on proceeds from a crime, she said.

“Any proceeds related to the sale of marijuana is technically the proceeds of crime under federal law, so that means it’s subject to forfeiture and seizure, and you could be accused of laundering money,” Angotti said.

The federal government has not consistently adopted a policy broadly defining proceeds related to the sale of marijuana, Angotti said, because the Obama administration said it had no plans to enforce any broad definition of marijuana-related businesses or prosecute banks or brokerages for “laundering” their funds, but then the Trump administration declared a reversal.

Without more clarity from the federal government, brokerages’ regulatory obligations are tricky to discern, Angotti said. Are clients going to “finance a strip mall, that’s going to be renting to a marijuana dispensary or provide insurance payments for marijuana-related businesses,” she posed, and will those be governed by federal laws making the proceeds illegal?

Although the answers are not clear, Merrill executives may have determined prior to announcing their new policy that they have enough experience to make more streamlined judgments, based on the types of prospective clients and businesses that advisors have recently sought to onboard, Angotti said.

Merrill executives on August 25 unveiled Project Thunder, telling advisors they would introduce 24 changes over eight weeks based on their feedback. Among the first changes announced: some trainees’ eligibility to join teams directly, modifications to the 24-hour trading rule, and the inclusion of alternative investments in a personal wealth analysis tool.

“I would say all good things but not monumental,” texted one veteran Merrill advisor in Florida, who asked not to be named, in response to the changes announced this week.

Read more at