GREAT BARRINGTON — A community impact fee levied against marijuana businesses does not amount to “legalized extortion,” a Select Board member said recently.

Edward Abrahams’ defense of the town’s 3 percent fee on marijuana sales comes at a time when the fee is coming under increased scrutiny in municipalities across the state.

The Hampshire County city of Northampton announced this year that it no longer would collect the impact fee from cannabis businesses unless a specific impact can be identified related to specific cannabis businesses. State lawmakers have filed bills advocating that the fee be nixed altogether or that its scope be narrowed.

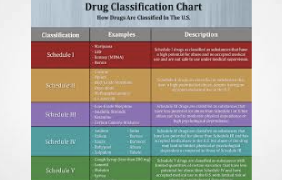

The impact fees are one of two separate taxes that provide municipalities with a source of cannabis-related revenue. The second is a 3 percent local sales tax added to the state excise and sales taxes.

Unlike the sales tax, the impact fees are negotiated between municipalities and cannabis applicants under state-mandated host community agreements. By law, the impact fees collected by the town must be used for programs or expenses related to offsetting potential negative effects of marijuana use.

Priority is given to town-based groups and organizations, particularly those that educate adolescents about the potential danger of marijuana use on young brains.