We once again visit the Tax Court’s decision in Harborside[1]. This time we will focus on statements made to the public and in financial statement related disclosures. More importantly, we will focus on what has NOT been said. Lest anyone suggest we are beating a dead horse, the Tax Court decision yesterday in Northern California Small Business Assistants, Inc. v. Commissioner, 153 T.C. No. 4 (October 23, 2019), confirms the predictions we made two years ago.

We will begin with the press release issued by Harborside stating,

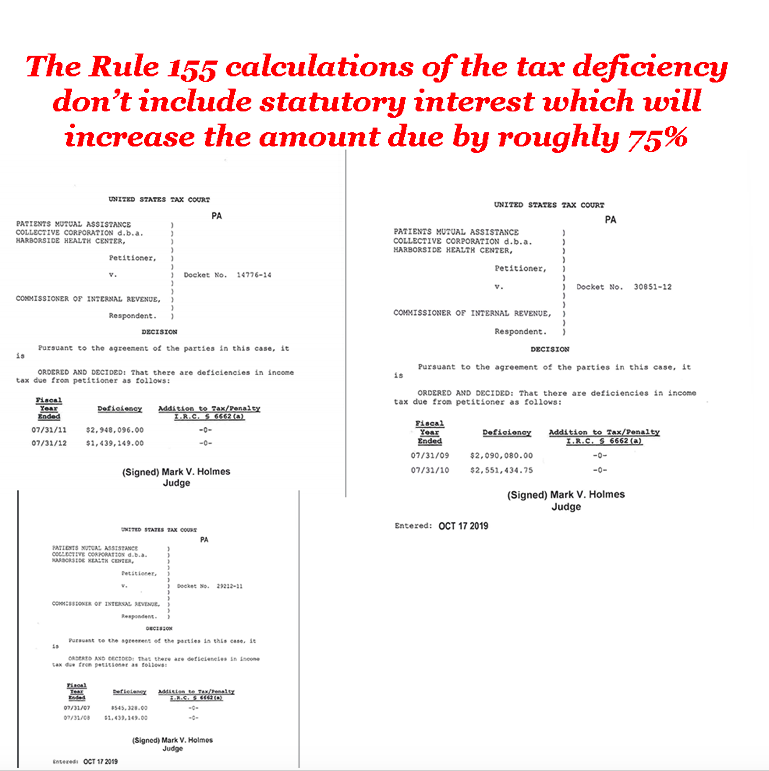

“OAKLAND, CA and TORONTO, Oct. 21, 2019 /PRNewswire/ – Harborside Inc. (“Harborside” or the “Company”) (CSE: HBOR), today announced that the U.S. Tax Court has issued a final decision under Tax Court Rule 155 on the income tax deficiency for Patients Mutual Assistance Collective Corporation (“PMACC”), the Company’s 100% owned subsidiary and owner of the iconic Harborside Oakland cannabis dispensary.

The U.S. Tax Court has ruled that PMACC owes an aggregate tax deficiency of approximately $11.0 million for the fiscal years 2007 through 2012. This amount is consistent with the Company’s one-time provision for its estimated tax obligation for PMACC expensed in its financial results for the three-month period ended June 30, 2019.

All dollar amounts in this press release are expressed in U.S. dollars.

“The Tax Court’s final computation of our tax obligation in PMACC’s long-standing 280E case is a good outcome for Harborside shareholders. By challenging the IRS’s overly aggressive interpretation of the tax law as it applies to cannabis businesses operating legally under State law, we have succeeded in reducing Harborside’s liability from the $36 million originally sought by the IRS to approximately $11 million – a $25 million reduction. The reduction includes $6 million in penalties that the court previously ruled we did not need to pay because of the unclear state of the law, and because Harborside acted in good faith,” said Harborside CEO Andrew Berman. “This ruling is also an important one for the cannabis industry in that, through this litigation, the court recognized there are legitimate deductions that legal cannabis companies can take in cost of goods sold. Harborside still intends to appeal the Tax Court’s ruling with regard to aspects of the decision as it pertains to the calculation of cost of goods sold, and has already retained appellate tax counsel.”

Steve DeAngelo, Harborside’s co-founder and Chairman Emeritus, also commented, “Harborside’s policy towards the federal government has always been to exhaust all reasonable available legal options to pursue justice. That policy has been validated by the Tax Court’s downward adjustment of PMACC’s liability. This outcome has strengthened our already strong resolve to continue pursuing justice by appealing the decision, with the goal of modifying or reducing 280E liability for Harborside, and in the future, eliminating it for every other state legal cannabis business in the United States. The issues at stake are of importance to the entire cannabis industry.”

The Company has 90 days within which to file an appeal with the United States Court of Appeals for the Ninth Circuit.

The US Tax Court has not yet issued a final ruling on the tax deficiency for San Jose Wellness (“SJW”). The Company estimates that the deficiencies in tax and penalties asserted by the IRS, not including interest calculations, are approximately $4.4 million. As of June 30, 2019, the Company recorded a one-time provision of $4.4 million in relation to the tax rulings on SJW.”

We note that Harborside’s statement omits several significant items that will certainly factor into the ultimate outcome related to the tax litigation.

The press release fails to acknowledge that the $11 million deficiency is the amount of the tax due. This amount does NOT include a provision for statutory interest which will accrue from the date the income tax liability was due and payable. We estimate interest will increase the amount owed by Harborside for these 2007-2012 tax liabilities by approximately $8.0 million.

The Management Discussion that accompanied Harborside’s financial statements for the quarter ended May 31, 2019 included the statement,

“The primary reason for the 2019 net loss increase over the prior year is the inclusion in the second quarter of a one-time provision of $15.4 million relating to potential tax liabilities under Section 280E of the Internal Revenue Code. The Company contests in all aspects any and all such liabilities, and the recording of this one-time provision is not an indication of the Company’s position on this matter or an admission of any liability.”

The lack of detail provided in the financial statement disclosures required by Canadian stock exchanges precludes us from seriously delving into the details are likely to have been available for a US issuer of securities through its ASR-149 disclosures.

In the first opinion Judge Holmes rejected the manner in which the dispensaries in the Harborside cases determined Cost of Goods Sold (“COGS”). Judge Holmes agreed with the Chief Counsel Memorandum[2] that Internal Revenue Code (“IRC”) §471 should be used by a cannabis dispensary to determine COGS. The Harborside opinion rejected the use of IRC Sec. 263A and approved the use of IRC Sec. 471 in the determination of COGS. The Harborside opinion allows a well-advised California dispensary to increase COGS for indirect costs pursuant to IRC Sec. 471 in a proper instance.

There are significant lessons for other cannabis dispensaries in California to glean from what are now two reviewed Tax Court decisions.

A dispensary which filed its tax returns in a manner consistent with Harborside for “open” years subsequent to 2012 has the ability to amend those returns and make changes from the utilization of the IRC Sec. 263A rules to the IRC Sec. 471 rules. This window of opportunity, however, is likely closed for most who did not act promptly following Judge Holmes decisions.

Harborside appears to have at least doubled its revenue in the six succeeding years. Harborside may have a substantially larger federal income tax liability for the five succeeding years – 2013-2017. For 2018, of course, the federal tax rules changed again, and not in favor of cannabis dispensaries, as a consequence of the changes in California law relating to the cannabis industry.

Judge Mark V. Holmes unequivocally stated that for years beginning after 2015[3], taxpayers in the cannabis business are deemed to be on notice that they do not have protection from the IRC Sec. 6662 accuracy-related penalties if they rely upon IRC Sec. 263A. Such dispensaries must use the provisions of IRC Sec. 471 and the regulations thereunder to determine COGS.

As is noted above, the benefit the Harborside opinion gave to California dispensaries under IRC Sec. 280E has a limited useful life. The Bureau of Cannabis Control [“BCC”] promulgated Regulations that restrict the processing, packaging. labeling and testing of cannabis to distributors for years after 2018.

The standard practice for California dispensaries had been to purchase flower in bulk and process and package, label, and possibly test the flower in-house. With proper substantiation, the opinion in Harborside permited a dispensary to utilize IRC Sec. 471 to increase COGS for both the direct and indirect costs properly allocable to the handling, processing, packaging, and security for the conversion of bulk purchases of cannabis inventory into a retail product.

The Harborside opinion approves the use of IRC Sec. 471. California’s regulation of its cannabis industry, however, now prohibits a dispensary from processing products for retail sale. A California dispensary must acquire cannabis products from a distributor in a consumer-ready form. Commercial cannabis products must be acquired by a California dispensary fully packaged and labeled. As a consequence of this regulatory requirement, effective January 1, 2018, a California dispensary is effectively subject to income tax on Gross Income (Gross Revenue less Cost of Goods Sold [“COGS”]) for federal income tax purposes.

The combination of the Tax Court’s decision in Harborside combined with the BCC regulations that take effect after 2017 made it almost impossible for a cannabis dispensary in California to generate after-tax income. The Tax Court’s decision in Northern California Small Business Assistants, Inc. makes it even more difficult.

[1] 151 TC 11

[2] CCM 201504011

[3] The tax year 2015 is viewed as significant for two reasons, the more important reason being that the Tax Court’s decision in Olive v. Commissioner, 139 TC 19, 36-42 (2012) aff’d 792 f.3d 1146 [CA-9, 2015] which was the first discussion of the phrase “consists of” in IRC Sec. 280E. Olive did not become final and unappealable until 2015. The second reason is the issuance of CCM 201504011, which was the first guidance from the IRS relating to IRC Sec. 280E. The IRS has never promulgated regulations relating to IRC Sec. 280E.