BONG SCORE

We apply our entirely subjective bong score to each event

1 Don’t Bother Unless You Need A Well Deserved Sleep

2 You Might Learn Something But We Hope You Didn’t Pay For It

3 This is really something, interesting presenters, well worth the money, and i actually will learn something

BLURB

Tuesday, June 14 at 1 p.m. ET for our free webinar “IRS Audits: Mistakes to Avoid,” where Nick Richards, former IRS attorney and Partner & Chair of the Cannabis Law Group at Greenspoon Marder, will outline important considerations in the event that your business is selected for an audit, including:

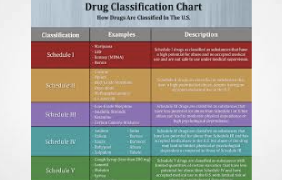

- The history of 280E and BSA audits of cannabis companies—and where the industry stands today

- Lessons learned from current tax litigation involving U.S. cannabis businesses

- The tax implications of company formation (e.g., S Corporation, C Corporation, LLC)

- The importance of proper cash reporting for all major business transactions (Form 8300)

- The expertise you need on-hand during an audit

- How to interact with auditors during digital, phone and in-person communications

- What types of audit-related documentation should be easily accessible

- How to handle an audit proposal and reach a favorable settlement

You’ll also have the opportunity to ask questions during a live Q&A period.