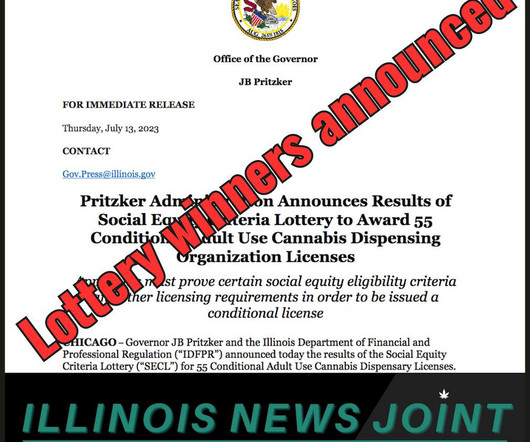

Oregon Cannabis PSA: A Little Grace on Retailer Tax Compliance Requirements

Canna Law Blog

SEPTEMBER 20, 2023

It’s been a minute since we wrote about the new OLCC tax compliance rules for retailers. These temporary rules require all retailers to certify tax compliance via the Oregon Department of Revenue (DOR) in order to renew or transfer ownership of a marijuana retailer license. From this week’s experience, I have some good news to share.

Let's personalize your content