Lawzilla has published the following

HENRY G. WYKOWSKI v. FRANK CHIMIENTI

Filed 10/28/19 Wykowski v. Chimienti CA2/5

NOT TO BE PUBLISHED IN THE OFFICIAL REPORTS

California Rules of Court, rule 8.1115(a), prohibits courts and parties from citing or relying on opinions not certified for publication or ordered published, except as specified by rule 8.1115(b). This opinion has not been certified for publication or ordered published for purposes of rule 8.1115.

IN THE COURT OF APPEAL OF THE STATE OF CALIFORNIA

SECOND APPELLATE DISTRICT

DIVISION FIVE

HENRY G. WYKOWSKI,

Plaintiff and Respondent,

v.

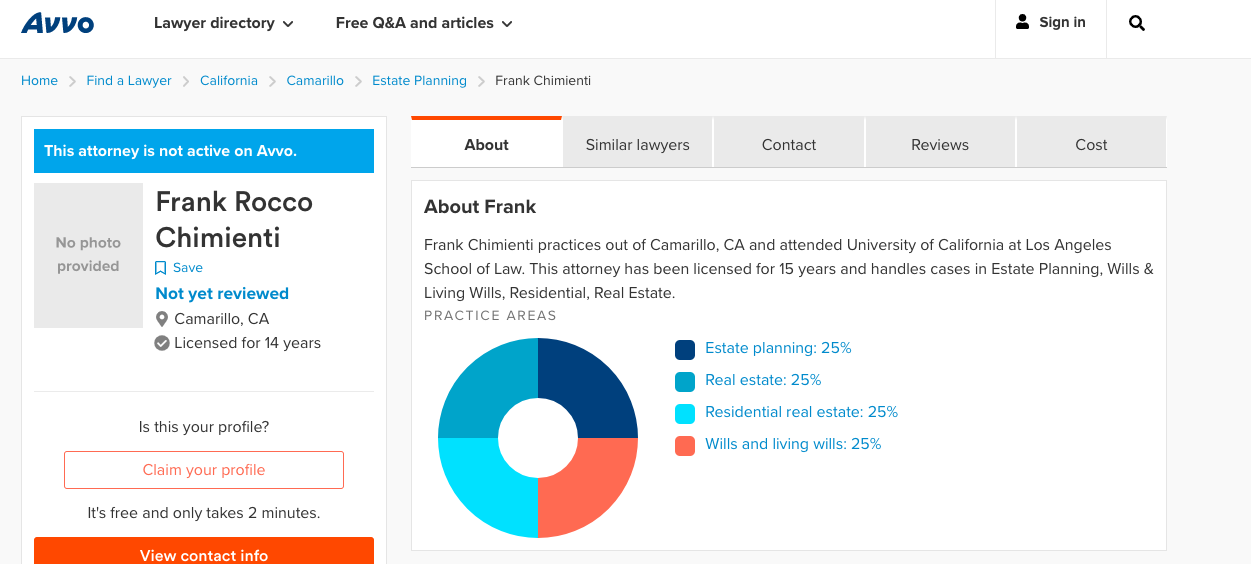

FRANK CHIMIENTI,

Defendant and Appellant.

B293271

(Los Angeles County

Super. Ct. No. BC709545)

APPEAL from an order of the Superior Court of Los Angeles County, David S. Cunningham III, Judge. Affirmed.

Law Offices of J. David Nick and J. David Nick for Defendant and Appellant.

Law Office of Andrew Scher and Andrew F. Scher for Plaintiff and Respondent.

I. INTRODUCTION

Defendant Frank Chimienti appeals from an order denying his special motion to strike pursuant to Code of Civil Procedure section 425.16, also known as the anti-SLAPP statute. Plaintiff Henry G. Wykowski sued Chimienti, an attorney, for malicious prosecution. Wykowski alleged that Chimienti was actively involved in the filing of a legal malpractice lawsuit against him, without probable cause and with malice. Chimienti argued in his anti-SLAPP motion that Wykowski could not demonstrate a probability of success on the merits of his claim. The trial court denied the motion. We affirm.

II. BACKGROUND

A. IRS Proceeding

Daniel Sosa owned and operated Mid City Cannabis Club, a marijuana dispensary (Mid City). Chimienti was business counsel for Sosa and Mid City. In March 2011, the IRS audited Sosa and Mid City for tax years 2007 to 2009. On January 27, 2012, the IRS issued an Income Tax Discrepancy Adjustment to Sosa, stating that he owed approximately $35,000 for tax years 2007 to 2009 (January 2012 Demand Letter). Sosa retained Michael Zipperstein as his accountant. On or about October 18, 2012, the IRS issued a revised demand letter, stating that Sosa owed approximately $135,000 in taxes (October 2012 Demand Letter).

In November 2012, Chimienti contacted Wykowski and explained that he was helping Sosa and Mid City with the IRS audit and would oversee, manage, and handle the accountants and tax attorneys that Sosa planned to hire. On November 26, 2012, Chimienti sent Wykowski an “‘intake email,’” which attached the October 2012 Demand Letter and requested that Wykowski call about “a referral fee.” After receiving the email, Wykowski spoke to Chimienti and declined to pay Chimienti a referral fee.

On January 10, 2013, Sosa retained Wykowski to represent him in the IRS proceeding. Sosa instructed Wykowski to file a petition challenging the IRS’s demand for payment.

In May 2014, Sosa instructed Chimienti to tell Wykowski to withdraw the petition, which Wykowski did.

On May 30, 2014, Wykowski, on behalf of Sosa, entered into a settlement agreement with the IRS, in which Sosa agreed that he owed $128,119.98 in taxes for the 2009 tax year. On July 10, 2014, the settlement was entered as a United States Tax Court decision.

On August 25, 2014, Sosa received an updated bill from the IRS, which sought approximately $135,000 in taxes for the years 2007 to 2009.

Sometime later, Wykowski’s legal assistant sought to collect outstanding legal fees from Sosa and sent him an email requesting payment. Chimienti responded by email, stating that Sosa was dissatisfied with the settlement and asked, “Now you are coming at the client with a $32,000 bill? I propose that you squash the entire bill and chalk it up to a lesson learned[.]” (Italics omitted.) On February 6, 2015, Chimienti sent another email to Wykowski’s legal assistant stating: “[S]hould collection efforts continue concerning this matter I am advising the client to retain counsel to file a malpractice claim. [¶] If [Wykowski] would like to send over a mutual release—my client forgoing his claims and the firm forgiving any amounts it claims are due and owing for work done on this matter, I will pass it on to the client for review.”

B. Malpractice Lawsuit

On March 9, 2016, Sosa and Mid City, represented by a lawyer who is not a party to this appeal, filed a complaint against Wykowski and Zipperstein, alleging that the two had engaged in professional negligence (the Malpractice Lawsuit). Among other things, the complaint alleged that in “February 2014, Wykowski and Zipperstein incorrectly informed . . . Sosa that if he did not challenge the IRS’s position, his individual tax liability would be approximately $35,000, as reflected in the [January 2012 Demand Letter].” The complaint further alleged that Wykowski and Zipperstein were “aware of the [October 2012 Demand Letter], but never discussed it with Mr. Sosa.” Sosa further alleged that Wykowski did not discuss the terms of the settlement with him and did not show the settlement or the final decision of the tax court to him. According to the complaint, Sosa did not learn that the IRS sought $135,000 in taxes until April 2015, when he received a response to his Freedom of Information Act request. Sosa alleged that but for Wykowski and Zipperstein’s advice, he would have continued to challenge the IRS’s assessment and would have either prevailed or paid a much smaller amount than the settlement.

On September 15, 2017, Wykowski moved for summary judgment. Wykowski asserted that Sosa’s claim against him was barred by the statute of limitations set forth in section 340.6. Wykowski further argued that Sosa could not demonstrate that Wykowski had breached any duty to him.

The trial court granted Wykowski’s motion. In granting summary judgment, the court ruled that Sosa’s complaint was time-barred. The court also concluded that Sosa had failed to produce any evidence that Wykowski knew or should have known that Sosa subjectively believed his personal tax liability was only $35,000. In reciting the undisputed facts, the court noted that Sosa admitted he received the October 2012 Demand Letter at his home and brought the letter to Zipperstein and Chimienti, but nonetheless claimed that he “was unaware of the revised amount when he met with Zipperstein and Chimienti and the envelope containing the revised amount was opened. When he instructed Chimienti to tell Wykowski to withdraw the petition regarding his personal tax liability, Wykowski confirmed the instruction by email with Chimienti and attached a copy of the revised demand. Chimienti admit[ted] he did not look at [the] attachment.”

The trial court continued, “[Wykowski] has demonstrated that he had no way of knowing that Mr. Sosa had the subjective impression that Sosa’s tax liability was $35,000. When he was engaged, Wykowski was provided by . . . Zipperstein and . . . Chimienti on November 2012, a scanned copy of the [October 2012 Demand Letter]. He was never provided with the [January 2012 Demand Letter].”

Finally, the trial court discussed Chimienti’s deposition testimony: “Chimienti testified that his role was to act as a go between vis-[à]-vis Wykowski and Sosa. Chimienti admitted at his deposition that he received an email from Wykowski indicating that Wykowski had filed a petition challenging Sosa’s personal taxes and challenged only the erroneous capital gains. Those capital gains were the reason for the amended amount and should have alerted Chimienti that a different amount was being sought. Chimienti admit[ted] that if he’d read the email, which he admit[ted] he did not, it would have rung a bell that something was amiss and Chimienti would have asked to look at the petition. This appears to be Chimienti’s mistake rather than Wykowski’s mistake.”

B. Wykowski’s Malicious Prosecution Complaint

On June 12, 2018, Wykowski filed his malicious prosecution complaint against Sosa and Chimienti. Wykowski alleged that Chimienti was “actively involved” in the filing of the Malpractice Lawsuit. The complaint attached: (1) the complaint in the Malpractice Lawsuit; (2) Wykowski’s motion for summary judgment; and (3) the trial court’s order granting summary judgment.

C. Anti-SLAPP Motion

On July 2, 2018, Chimienti filed an anti-SLAPP motion. He asserted, and it is not disputed, that the malicious prosecution complaint arose from Chimienti’s protected activity. Chimienti further argued that Wykowski could not demonstrate a probability that he would prevail on his claim because, among other things, Wykowski could not establish the underlying action was brought at Chimienti’s direction.

In response, Wykowski submitted his declaration, which described the email communications between Wykowski’s legal assistant and Chimienti regarding the outstanding legal fees, and attached the February 6, 2015, email message from Chimienti.

On August 1, 2018, the trial court issued its ruling denying the anti-SLAPP motion. The court found that although Chimienti’s alleged conduct was protected activity under the anti-SLAPP statute, Wykowski had demonstrated a probability of success on the merits of his malicious prosecution cause of action.

III. DISCUSSION

A. Anti-SLAPP Principles

Section 425.16, “California’s so-called anti-SLAPP (strategic lawsuit against public participation) statute, is intended to resolve quickly and relatively inexpensively meritless lawsuits that threaten free speech on matters of public interest.” (Newport Harbor Ventures, LLC v. Morris Cerullo World Evangelism (2018) 4 Cal.5th 637, 639.) “A court’s consideration of an anti-SLAPP motion involves a two-pronged analysis. [Citation.] . . . [T]he Supreme Court has expounded on the standards to be applied in this two-pronged analysis: ‘At the first step, the moving defendant bears the burden of identifying all allegations of protected activity, and the claims for relief supported by them . . . . If the court determines that relief is sought based on allegations arising from activity protected by the statute, the second step is reached. There, the burden shifts to the plaintiff to demonstrate that each challenged claim based on protected activity is legally sufficient and factually substantiated. The court, without resolving evidentiary conflicts, must determine whether the plaintiff’s showing, if accepted by the trier of fact, would be sufficient to sustain a favorable judgment. If not, the claim is stricken.’” (Medical Marijuana, Inc. v. ProjectCBD.com (2016) 6 Cal.App.5th 602, 614.)

B. Standard of Review

An order denying a special motion to strike under section 425.16 is directly appealable. (§§ 425.16, subd. (i) and 904.1, subd. (a)(13).) We review the trial court’s order de novo. (Sweetwater Union High School Dist. v. Gilbane Building Co. (2019) 6 Cal.5th 931, 940 (Sweetwater).)

C. Second Prong: Probability of Prevailing

Wykowski concedes, and we agree, that Chimienti has satisfied the first prong of the anti-SLAPP statute. “By definition, a malicious prosecution suit alleges that the defendant committed a tort by filing a lawsuit. [Citation.] Accordingly, every Court of Appeal that has addressed the question has concluded that malicious prosecution causes of action fall within the purview of the anti-SLAPP statute.” (Jarrow Formulas, Inc. v. LaMarche (2003) 31 Cal.4th 728, 735 (Jarrow).)

Because Chimienti met his burden on the first prong, the burden shifted to Wykowski to demonstrate that his claim had “‘“minimal merit”’” to proceed. (Sweetwater, supra, 6 Cal.5th at p. 940.) “As to the second step inquiry, a plaintiff seeking to demonstrate the merit of the claim ‘may not rely solely on its complaint, even if verified; instead, . . . proof must be made upon competent admissible evidence.’” (Ibid.) “[The court’s] inquiry is limited to whether the plaintiff has stated a legally sufficient claim and made a prima facie factual showing sufficient to sustain a favorable judgment.” (Baral, supra, 1 Cal.5th at pp. 384-385.)

“The tort [of malicious prosecution] consists of three elements. The underlying action must have been: (i) initiated or maintained by, or at the direction of, the defendant, and pursued to a legal termination in favor of the malicious prosecution plaintiff; (ii) initiated or maintained without probable cause; and (iii) initiated or maintained with malice.” (Parrish v. Latham & Watkins (2017) 3 Cal.5th 767, 775.)

1. Initiating Malpractice Lawsuit

Chimienti contends that Wykowski cannot demonstrate that he initiated or directed the Malpractice Lawsuit. According to Chimienti, he cannot be liable for malicious prosecution because he did not file the Malpractice Lawsuit; did not appear on the case; did not sign any pleadings; and, at least according to Chimienti, did not assist in the prosecution of the case once it was filed. In support of his argument, Chimienti cites the following language from Cole v. Patricia A. Meyer & Associates, APC (2012) 206 Cal.App.4th 1095 (Cole): “Attorneys may easily avoid liability for malicious prosecution without having to engage in premature work on a case if they refrain from formally associating in it until their role is triggered. Attorneys may also avoid liability if they refrain from lending their names to pleadings or motions about which they know next to nothing.” (Id. at p. 1119.) Chimienti’s argument is meritless.

In Cole, supra, 206 Cal.App.4th 1095 two sets of attorneys associated as counsel for plaintiff on a matter for purposes of trial but, before they conducted any legal work, the matter was decided in the defendant’s favor at summary judgment. (Id. at pp. 1103-1104.) The defendant then sued the attorneys of record in the underlying lawsuit for, among other claims, malicious prosecution. (Id. at p. 1104.) The trial court granted the attorneys’ anti-SLAPP motions “based on their representation that they did not participate” in the underlying lawsuit. (Ibid.) The Court of Appeal disagreed and rejected the attorneys’ argument that they could not be liable for malicious prosecution. (Id. at pp. 1115-1116.) As the Court of Appeal explained, “[W]e hold, among other things, that the attorneys’ anti-SLAPP special motions to strike . . . were improperly granted, and that attorneys who appear on all of the pleadings and papers filed for the plaintiffs in the underlying case cannot avoid liability for malicious prosecution merely by showing that they took a passive role in that case as standby counsel who would try the case in the event it went to trial.” (Id. at p. 1100, fn. omitted.) The Court of Appeal reasoned that the attorneys’ premature association in the matter, prior to trial, “undercuts the public policy argument that attorneys should not be required to create a record of diligence before their role as cocounsel is triggered.” (Id. at p. 1119.) It is in this context that the court made the statement quoted in Chimienti’s appeal. (See ibid.) Cole, supra, 206 Cal.App.4th 1095 thus does not support the proposition that lawyers who do not appear on pleadings are immune from malicious prosecution claims. (Hinerfeld-Ward, Inc. v. Lipian (2010) 188 Cal.App.4th 86, 101 [“‘“It is elementary that the language used in any opinion is to be understood in the light of the facts and the issue then before the court. [Citation.] Further, cases are not authority for propositions not considered. [Citation.]”’”]; Cicairos v. Summit Logistics, Inc. (2005) 133 Cal.App.4th 949, 957.)

Wykowski alleged that Chimienti was liable for malicious prosecution not because he appeared as counsel on pleadings but because he allegedly directed the filing of the Malpractice Lawsuit. Indeed, “‘[o]ne may be civilly liable for malicious prosecution without personally signing the complaint initiating the . . . proceeding. If a person, without probable cause and with malice, instigates or procures the [action], he is liable.’” (Jacques Interiors v. Petrak (1987) 188 Cal.App.3d 1363, 1371-1372; see also Pacific Gas & Electric Co. v. Bear Stearns & Co. (1990) 50 Cal.3d 1118, 1131, fn. 11 [“The instigator, as well as the party, may be liable” for malicious prosecution]; Nunez v. Pennisi (2015) 241 Cal.App.4th 861, 873 (Nunez) [“A person who did not file a complaint may be liable for malicious prosecution if he or she ‘instigated’ the suit or ‘participated in it at a later time’”].)

On this record, Wykowski has demonstrated sufficient merit as to this element. Chimienti’s role as Sosa’s business counsel, his self-described role as a go-between in the IRS proceeding, his sending of the October 2012 Demand Letter to Wykowski, his failure to send the January 2012 Demand Letter to Wykowski, and his February 6, 2015, email threatening to direct Sosa to sue Wykowski for legal malpractice, are sufficient to satisfy for anti-SLAPP purposes the first element of a malicious prosecution claim.

2. Lack of Probable Cause

Chimienti next argues that Wykowski cannot demonstrate that the Malpractice Lawsuit lacked probable cause. “‘Probable cause exists when a lawsuit is based on facts reasonably believed to be true, and all asserted theories are legally tenable under the known facts.’ [Citation.] The court must ‘determine whether, on the basis of the facts known to the defendant, the institution of the prior action was legally tenable.’ [Citation.] We evaluate this question of law under an objective standard, asking whether any reasonable attorney would have thought the claim tenable.” (Jay v. Mahaffey (2013) 218 Cal.App.4th 1522, 1540; Cole, supra, 206 Cal.App.4th at p. 1106.)

“A litigant lacks probable cause ‘“if he [or she] relies upon facts which he [or she] has no reasonable cause to believe to be true, or if he [or she] seeks recovery upon a legal theory which is untenable under the facts known to him [or her].”’” (Nunez, supra, 241 Cal.App.4th at p. 875.)

The mere granting of a summary judgment for the defense in the underlying action, without more, is insufficient to demonstrate lack of probable cause for a malicious prosecution action. (Jarrow, supra, 31 Cal.4th at pp. 742-743.) Here, however, Wykowski submitted the Malpractice Lawsuit complaint, the motion for summary judgment, the order granting summary judgment, and his declaration and attached email. The Malpractice Lawsuit alleged that Wykowski had misled Sosa into believing that his tax liability was $35,000 and had concealed from Sosa that the IRS actually sought $135,000 in taxes. The evidence submitted by Wykowski suggested not only that Wykowski had done neither of these things, but that it was Chimienti who was responsible for Sosa’s alleged misunderstanding. Wykowski thus made a prima facie factual showing that if Chimienti directed the filing of the Malpractice Lawsuit, he did so knowing it was not supported by probable cause.

3. Malice

Finally, Chimienti argues that Wykowski failed to meet his burden to demonstrate malice. “The malice element of malicious prosecution goes to the defendants’ subjective intent for instituting the prior case. [Citation.] Malice does not require that the defendants harbor actual ill will toward the plaintiff in the malicious prosecution case, and liability attaches to attitudes that range ‘“from open hostility to indifference. [Citations.]”’ [Citation.] Malice may be inferred from circumstantial evidence, such as the defendants’ lack of probable cause, supplemented with proof that the prior case was instituted largely for an improper purpose. [Citation.] This additional proof may consist of evidence that the prior case was knowingly brought without probable cause or was brought to force a settlement unrelated to its merits.” (Cole, supra, 206 Cal.App.4th at pp. 1113-1114; accord, Nunez, supra, 241 Cal.App.4th at p. 877.)

Again, the fact that Wykowski obtained summary judgment in his favor, by itself, does not establish the malice element as a matter of law. (Jarrow, supra, 31 Cal.4th at p. 743.) Here, however, Wykowski presented further evidence of improper motive. Chimienti’s statement that Sosa did not want to pay Wykowski’s attorney fees and Chimienti’s threat to advise Sosa to sue if Wykowski pursued the fees suggested that Chimienti was motivated by a desire to save money. Wykowski’s statement that he had previously rebuffed Chimienti’s request for a referral fee suggested a desire to retaliate. Finally, the trial court’s conclusion in the Malpractice Lawsuit, that Chimienti appeared to be responsible for Sosa’s misunderstanding about the taxes that he owed, suggested a desire to conceal. Such evidence supports the inference that Chimienti acted with malice. (Cole, supra, 206 Cal.App.4th at p. 1114.) Accordingly, Wykowski has made a prima facie factual showing as to the third element of malicious prosecution.

IV. DISPOSITION

The order denying the anti-SLAPP motion is affirmed. Plaintiff Henry G. Wykowski is entitled to recover costs on appeal.

NOT TO BE PUBLISHED IN THE OFFICIAL REPORTS

KIM, J.

We concur:

BAKER, Acting P. J.

MOOR, J.

More Information About the Parties

Henry G. Wykowski & Associates

Henry G. Wykowski & Associates

State(s) Served: California

Year Founded: 1985

Description: Wykowski & Associates is one of the few firms in California that specializes in representing medical cannabis dispensaries and other related businesses.

Customers/Clients Include: N/A

Contact: 415-788-4545