Holland & Hart: Cannabis Taxation: Where Does the Money Go?

Cannabis Law Report

APRIL 3, 2023

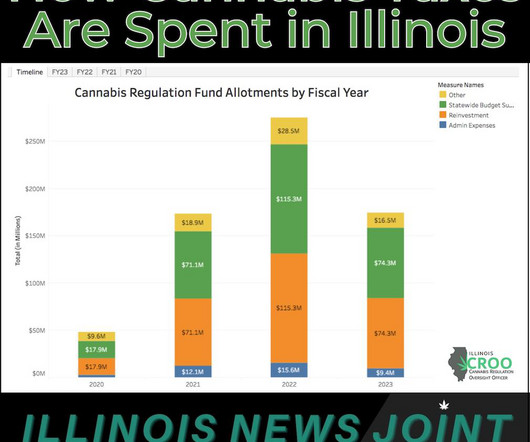

In the decade since adult-use markets first launched, local, and state governments have allocated billions of dollars in collected cannabis taxes to fund educational infrastructure, substance abuse prevention and treatment programs, public safety and many other initiatives designed to improve the lives of those living in […]

Let's personalize your content