Marijuana Policy Project (MPP) Reports Says States Have Collected $US10 Billion In Cannabis Taxes So Far

Cannabis Law Report

JANUARY 9, 2022

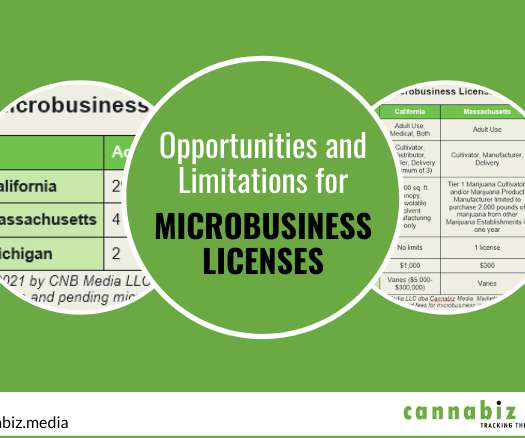

Since 2014 when sales began in Colorado and Washington, legalization policies have provided states a new revenue stream to bolster budgets and fund important services and programs. Eight of the laws were approved in 2020 or 2021, and in seven of those states, sales and tax collections have not yet begun. Here’s what they say.

Let's personalize your content