The Week in Weed: January 5, 2024

The Blunt Truth

JANUARY 5, 2024

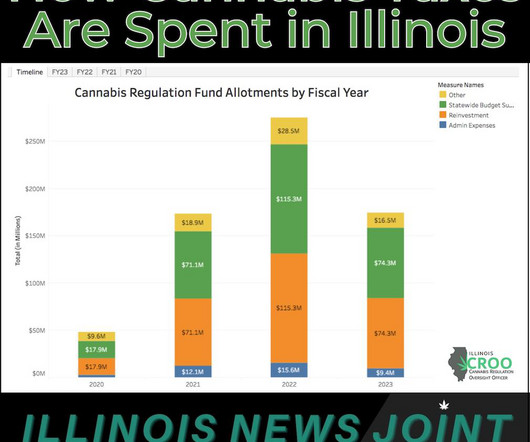

Happy 2024 – let’s start the year off with a shout-out to Colorado, where the retail market is celebrating an anniversary. There’s an update on Alabama’s medical cannabis licensing program (meet the new year; same as the old year). Since that time, the industry has taken in $15 billion in revenue, with the state collecting $2.6

Let's personalize your content