CCT CET: Responsible Persons, “Collection & Remittance of Cannabis Excise Tax [“CET”] & Cannabis Cultivation Tax [“CCT”]

Cannabis Law Report

JANUARY 9, 2019

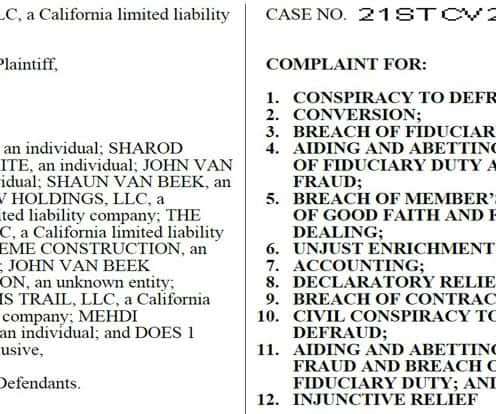

The weakness relates to the collection and remittance of Cannabis Excise Tax [“CET”] and Cannabis Cultivation Tax [“CCT”]. The weakness relates to the collection and remittance of Cannabis Excise Tax [“CET”] and Cannabis Cultivation Tax [“CCT”]. Author – aBIZinaBOX Inc: Jordan S.

Let's personalize your content