Marijuana Policy Project (MPP) Reports Says States Have Collected $US10 Billion In Cannabis Taxes So Far

Cannabis Law Report

JANUARY 9, 2022

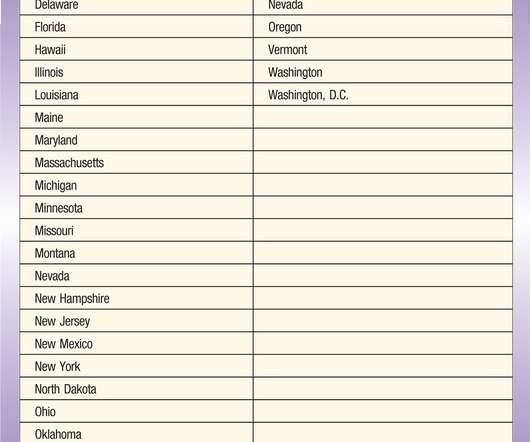

Eight of the laws were approved in 2020 or 2021, and in seven of those states, sales and tax collections have not yet begun. Colorado already had a developed medical cannabis regulatory system, and many businesses were able to transition to having both a medical and an adult-use counter. Also, until July 2017, a 2.9% 46,104,922.

Let's personalize your content