Section 280E and The Taxation of Cannabis Businesses

Cannabis Law Report

AUGUST 23, 2021

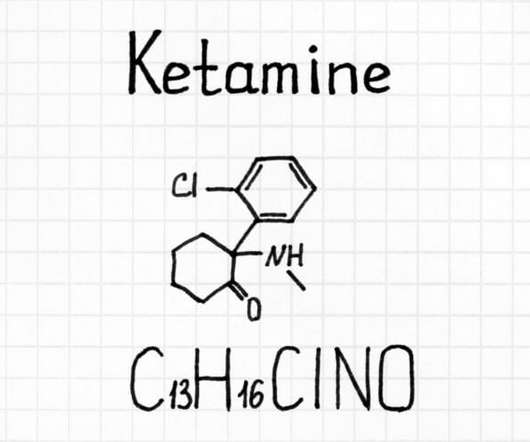

Section 280E of the Internal Revenue Code prohibits taxpayers who are engaged in the business of trafficking certain controlled substances (including, most notably, marijuana) from deducting typical business expenses associated those activities. Controlled Substance.

Let's personalize your content