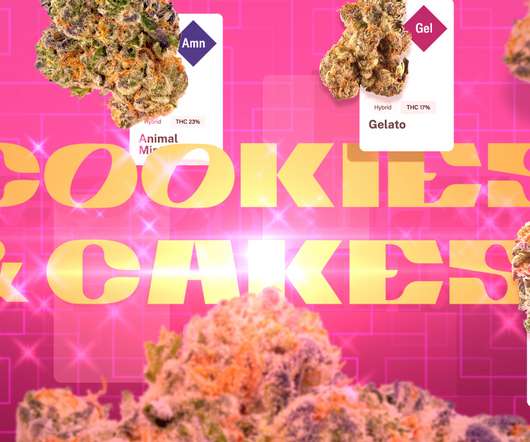

Just desserts: The Cookies and Cakes family genealogy

SpeedWeed

APRIL 16, 2021

From 2007 to the present—and emanating out of the San Francisco Bay Area—Cookies’ hard-hitting, hybrid indica power, and its complex, sweet- scrumptious aroma has made fans of elite pot snobs, medical marijuana patients with PTSD, all-star rappers, and now almost everyone who partakes. Mr. Sherbinski. The profits outweighed the risk.

Let's personalize your content